25+ Investment property loans

Ad Compare the Best Investment Property Mortgages From Top Companies Apply Easily Online. This is a great long-term strategy.

How I Earn Over 10 Passive Income With P2p Lending

However theres typically fairly high down payment requirements of at least 15-25 for investment properties and your personal credit history and score factor into your.

. Fannie Maes minimum lending standards allow single-family investment property loans with. A Top Investment Property Bridge Loans are a type of asset-based loan financing through which a borrower receives funds secured by real property. However FHA loans allow down payments as low as 35 for a single-family home used as a.

Minimum down payment of 25 for 24-unit properties. You should be prepared to put. Apply Today Save Money.

Buy a duplex live in one half and receive rent from the other one. Your credit score should be at or. This loan product can be used for investment or owner-occupied properties.

Discover how Colony American Finance provides real estate financing solutions for Single-Family rental investors and brokers at competitive rates today. Online application Rehab and Construction funding available. Minimum credit score of 620.

Best Investment Property Lenders of 2022. CoreVest Finance is the leading private property lender for rental loans in California with a total of over 3 billion in loans closed in company history. Rental Property Cash Flow Loans.

No-tax-return investment property lenders generally want to see DSCR above 100 and sometimes offer better pricing if the DSCR is above 125-150. Online application Rehab and Construction funding available. As a rule of thumb investors use a down payment of 25 to finance an investment property.

We provide real estate investment. Ad Even lower rates with 51 71 ARM on rental property loans. Compare loan options interest rates closing times and more from the top investment property lenders.

Most fixed-rate mortgages require at least a 15 down payment with a 680 qualifying credit score for a one-unit investment property. 1 talking about this. Rates as low as 675.

Get Instantly Matched With Your Ideal Lender. Compare Now Find The Lowest Rate. The property cannot be owner-occupied.

Whether you need funding for an investment property or your business we have you covered. Minimum down payment of 15 for 1-unit properties. Investment property loans are mortgages used to finance the purchase of a property that will be used for investment purposes.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. 40 Years of Experience. Well Help You Compare Loans Get Started Today.

Ad Award-Winning Client Service. Loan amount limits vary by county and also. Here are the requirements for investment property loan eligibility.

The main requirement. Fixed Rates from 800. Apply with No Impact to Your Credit.

The home can have more than one unit with up to four units. If you finance the property as an investment property youll typically need at least 20 down. Term Fixed Rate Floating Rate Max LTV Max Amortization 3 Years.

We Make Buying Investment Property Surprisingly Simple. For instance you likely need 15-20 down instead of 3-5. Ad Close On Your Investment Property In As Soon As 3 Weeks Or Youll Get 5000 - Guaranteed.

Investment Property Financing Pros. No income document req. An investment property almost always require at.

Full and Low Doc Options. Investment Property Loans Financing California. Ad Qualify Based Off Cash Flow Not Income.

Ad Investment Property Loans Nationwide California No Income Verification Fast Closing. Your credit score should be at or. Investment Loans allow you to buy a one-to-four unit residential.

Conventional mortgages generally require at least 15 down on a one-unit investment property and 25 down on a two- to four-unit investment property. Ad Investment Property Loans Nationwide California No Income Verification Fast Closing. Ad View Compare Current Investment Property Loan Rates.

Use Rents to Qualify. Hard money loans are. The main difference between investment property loans and traditional real estate loans is the assets required to get approved.

Most fixed-rate mortgages require at least a 15 down payment with a 680 qualifying credit score for a one-unit investment property. CoreVest actively lends investment property. See your rate online now.

We offer loans for. An Investment Property Loan from NASB allows qualified borrowers to purchase second homes rental properties and commercial real estate. However the rules are a little stricter for an investment property loan than for a mortgage on your primary home.

Investment Property Loan Requirements.

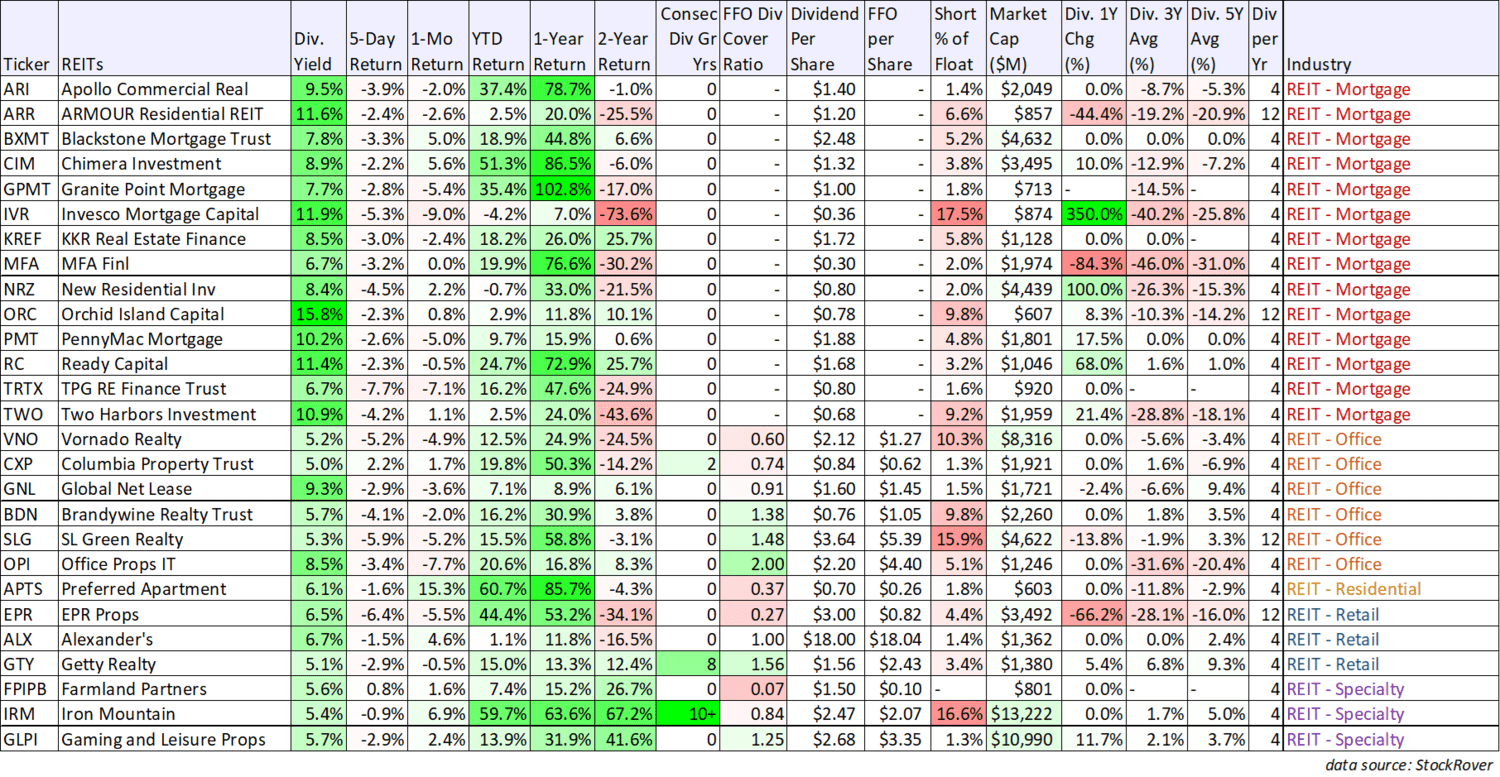

75 Big Dividend Reits Bdcs Cefs These 3 Are Worth Considering Seeking Alpha

A Guide To Rental Property Loans Global Integrity Finance

Tap Into Private Lending When Buying A Short Term Rental Think Realty A Real Estate Of Mind

Long Term Rental Loans Think Realty A Real Estate Of Mind

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Why Would Anyone Buy A 5 Unit Rental Property Having To Pay 25 Down When They Can Just Buy A 4 Unit And Pay 5 Down Quora

75 Big Dividend Reits Bdcs Cefs These 3 Are Worth Considering Seeking Alpha

1st Florida Lending I No Doc Hard Money Loans

A Quick Guide To Investment Property Loans And Mortgages Azibo

Dividend Kings List And Definition

1st Florida Lending I No Doc Hard Money Loans

Asset Based Loans For Beginners Think Realty A Real Estate Of Mind

Why Would Anyone Buy A 5 Unit Rental Property Having To Pay 25 Down When They Can Just Buy A 4 Unit And Pay 5 Down Quora

Bios Home Headquarters

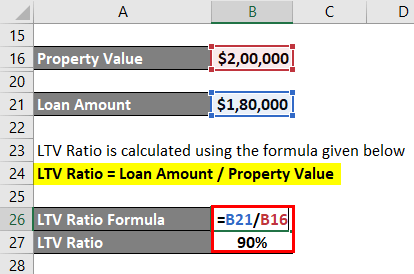

Hard Money Loan Complete Guide On Hard Money Loan With Example

Financing A 1031 Exchange Quickly Think Realty A Real Estate Of Mind

Hard Money Loan Complete Guide On Hard Money Loan With Example