40+ what percentage should your mortgage be

Web 1 day agoNearly all banks are insured by the FDIC which protects your deposits up to 250000 per person bank and account type. And your 25000 savings account are both protected.

Recommended Net Worth Allocation By Age And Work Experience

Were Americas Largest Mortgage Lender.

. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. First Time Home Buyer. I your monthly interest rate.

If you had 150000 in a savings account 50000 in a checking account and 100000 in a CD at Bank A the total. On some conforming conventional loans Fannie Mae and Freddie Mac set their maximum DTIs at. No more than 28 of a buyers pretax monthly income should go toward.

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Your lender likely lists interest rates as an annual figure so. If your anticipated homeownership.

Lock Your Mortgage Rate Today. Apply Now With Quicken Loans. Easily Compare Mortgage Rates and Find a Great Lender.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Web If the down payment is less than 20 mortgage insurance may be required which could increase the monthly payment and the APR. Save Time Money.

Web It typically ranges from 058 to 186 of your total mortgage amount and you will need to factor this in if your down payment is less than 20. Web M monthly mortgage payment P the principal or the initial amount you borrowed. Web The 35 45 Model.

Web How much of your income should go toward a mortgage. Web Depending on your lender a DTI above 43 may be allowed. Ad See how much house you can afford.

Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

Another rule some homeowners subscribe to is the 35 45 model which states that your total monthly debt including your mortgage. Estimate your monthly mortgage payment. Web You typically have to pay private mortgage insurance which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your.

Web 2 days agoIf not then say your 50000 CD. That means even if your bank implodes. The 2836 rule is a good benchmark.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web 2 days agoLets look at how it might work for you. Web As a general rule your total homeownership expenses shouldnt take up more than 33 of your total monthly budget.

The insurance costs nothing and you dont have to check a box when. Ad Calculate Your Payment with 0 Down. Ad Compare Mortgage Options Calculate Payments.

Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Should You Pay Off Your Mortgage Early With Rates So Low

25 Best Loan Service Near North Ridgeville Ohio Facebook Last Updated Mar 2023

Refinance Your Home Loan Save Lending Loop 40 Lenders

Cmp 14 07 By Key Media Issuu

Lngv 6cfzktrnm

The Pros And Cons Of A 40 Year Mortgage Rocket Mortgage

The Pros And Cons Of A 40 Year Mortgage Rocket Mortgage

U S Senator Elizabeth Warren I M Thrilled That The 1 1 Million Members Of The National Association Of Realtors Have Endorsed My Bank On Students Student Loan Refinancing Bill They Recognize That Student

What If You Always Maxed Out Your 401k

How To Raise Your Afterpay Limit All You Need To Know

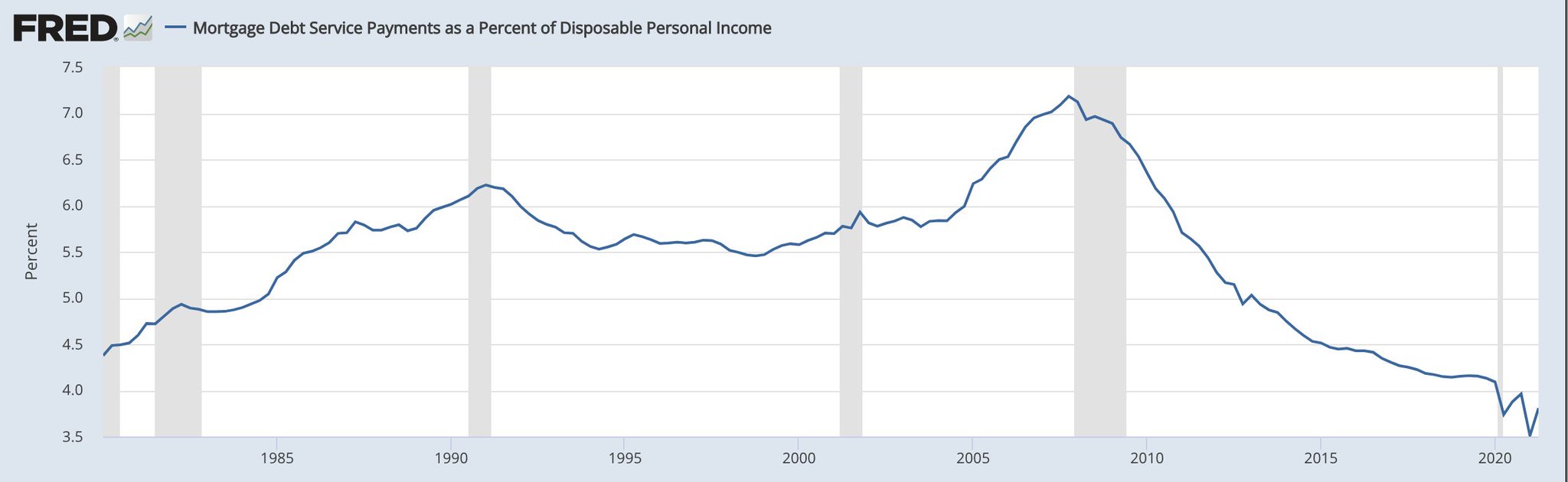

Morgan Housel On Twitter Two Worlds Home Prices Balloon But Mortgage Payments As A Percent Of Income Are At The Lowest Level In 40 Years If You Can Afford A Down Payment

Recommended Net Worth Allocation By Age And Work Experience

What Percentage Of Income Should Go To A Mortgage Bankrate

Warehouse Processing Homeowner Insurance Products Jumbo And Non Qm News Credit Suisse Mbs Settlement

How Much A 250 000 Mortgage Will Cost You Credible

40 Things Every 40 Should Know About Buying A Home Gobankingrates

What You Need To Know About Risk Tolerance Monevator